Search

Sally Michael has extensive experience representing owners and developers on acquisitions, dispositions, financings, development, and leasing of all classes of commercial property. Sally also represents borrowers and lenders on restructurings and workouts of distressed debt. She is lead counsel on...

Saul Ewing attorneys have been helping clients understand and comply with the Affordable Care Act (ACA) since its enactment in 2010. Our ACA Consulting Team consists of experienced employee benefits attorneys who understand how the ACA interacts with laws such as COBRA and HIPAA. Our team tracks the...

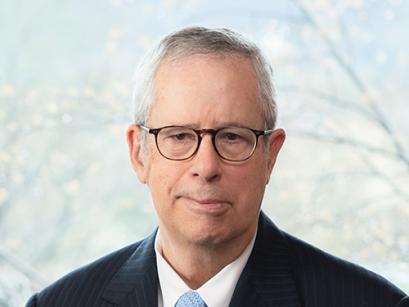

John Stoviak handles high-stakes litigation, complex trials and appeals for business, energy and environmental clients in courts throughout the United States, and he represents colleges, universities, and independent schools in delicate governance matters and issues. He has achieved two $100 million...

Michael Petrizzo brings nearly 30 years of experience to his work guiding clients through mergers and acquisitions, financing transactions, and corporate formations, reorganizations and restructurings. Public and private companies, private equity and venture capital firms, and high-net-worth...

Navigating the Complex World of Tax Law Saul Ewing's Tax Practice offers focused, in-depth knowledge of the intricacies associated with federal, state, and local tax law. The role of the Tax Practice is to provide clients with advice and representation in a wide variety of tax-related legal issues...

John P. Englert has almost 40 years of diverse environmental experience. Since 1994 John has practiced environmental law and before that he was an environmental consultant. In both capacities, he has served national and international companies in the energy, environmental and manufacturing sectors...

Responsive Service and Real-World Guidance Attorneys in Saul Ewing's Financial Services Practice advise and represent local, community and regional banks; credit unions; and other private and public finance entities in a wide range of transactional and business matters. We provide practical legal...

Jay M. Rosen focuses his practice in general corporate and securities law. He has represented both public and private companies in connection with mergers and acquisitions, public and private offerings of securities and SEC disclosure, as well as corporate governance, debt and equity financing and...

Andy Daly advises employers, including employee-owned companies, on legal issues connected with employee benefits. He focuses in particular on matters involving employee stock ownership plans (ESOPs), including: Handling ESOP transactions. Assisting with plan design. Evaluating feasibility issues...

Jim Taylor is a trial lawyer with first-chair experience handling complex litigation in federal and state courts. A significant portion of his practice uses that litigation experience and perspective to counsel clients in managing high-profile crises, minimizing financial and reputational risks...

Government is growing every day. Regardless of which political party is in power, the scope of government regulation at the state, county and local levels, and the impact of government on all types of business has regularly increased. Regardless of your type of business – manufacturing or finance...

Protecting the Rights of Corporate Clients Companies generally enjoy a fruitful relationship with their shareholders, but disagreements about management, perceptions of minority shareholder mistreatment, or concerns over executive compensation may arise. No matter the cause of shareholder...

Thomas Doyle advises companies on legal issues in connection with their daily operations and long-term business strategies. His experience includes representing clients in a variety of transactions, including mergers and acquisitions, venture financing and debt financing. Companies frequently rely...

Mary Harmon focuses her practice on advising corporations and passthrough entities on tax and contractual issues. Clients look to her for counsel on U.S. federal, state, local, and foreign tax compliance and planning issues, including matters relating to subchapter C, subchapter K, subchapter S and...

Alexander Reich is a trusted litigator and advisor who focuses on employment law. He counsels employers on an array of matters involving federal and state statutes such as Title VII, Title IX, the Age Discrimination in Employment Act (ADEA), the Americans with Disabilities Act (ADA) and the Family...

Kermit Nash counsels domestic and international clients on legal issues connected with their business operations, governance, strategy and investments. Privately held domestic and international corporations rely on Kermit to advise them on transactions ranging from mergers and acquisitions and sales...

Gary Lipkin represents companies and individuals in a wide array of corporate and commercial litigation matters. In his more than 20 years of legal practice, Gary has built an extensive track record handling cases before the nation's preeminent business court, the Court of Chancery of the State of...

Maria Carnicella advises clients on mergers and acquisitions and other major corporate transactions. In addition to M&A deals, she represents private and public entities and individual investors in stock and asset sales and acquisitions, private placements, reorganizations, IPOs, redemptions, and...

Anne Greene has broad experience in a variety of employee benefits matters, such as compliance for employee retirement plans, health and welfare plans, cafeteria plans, wrap plan documents, COBRA, the Affordable Care Act, plan claims and appeals processes and claim disputes, and prohibited...

The Corporate Transparency Act (CTA) imposes significant new reporting requirements on many small businesses, as of January 1, 2024. The law requires all “reporting companies” to identify their “beneficial owners” and “company applicants” in a report to be filed with the U.S. Treasury Department’s...